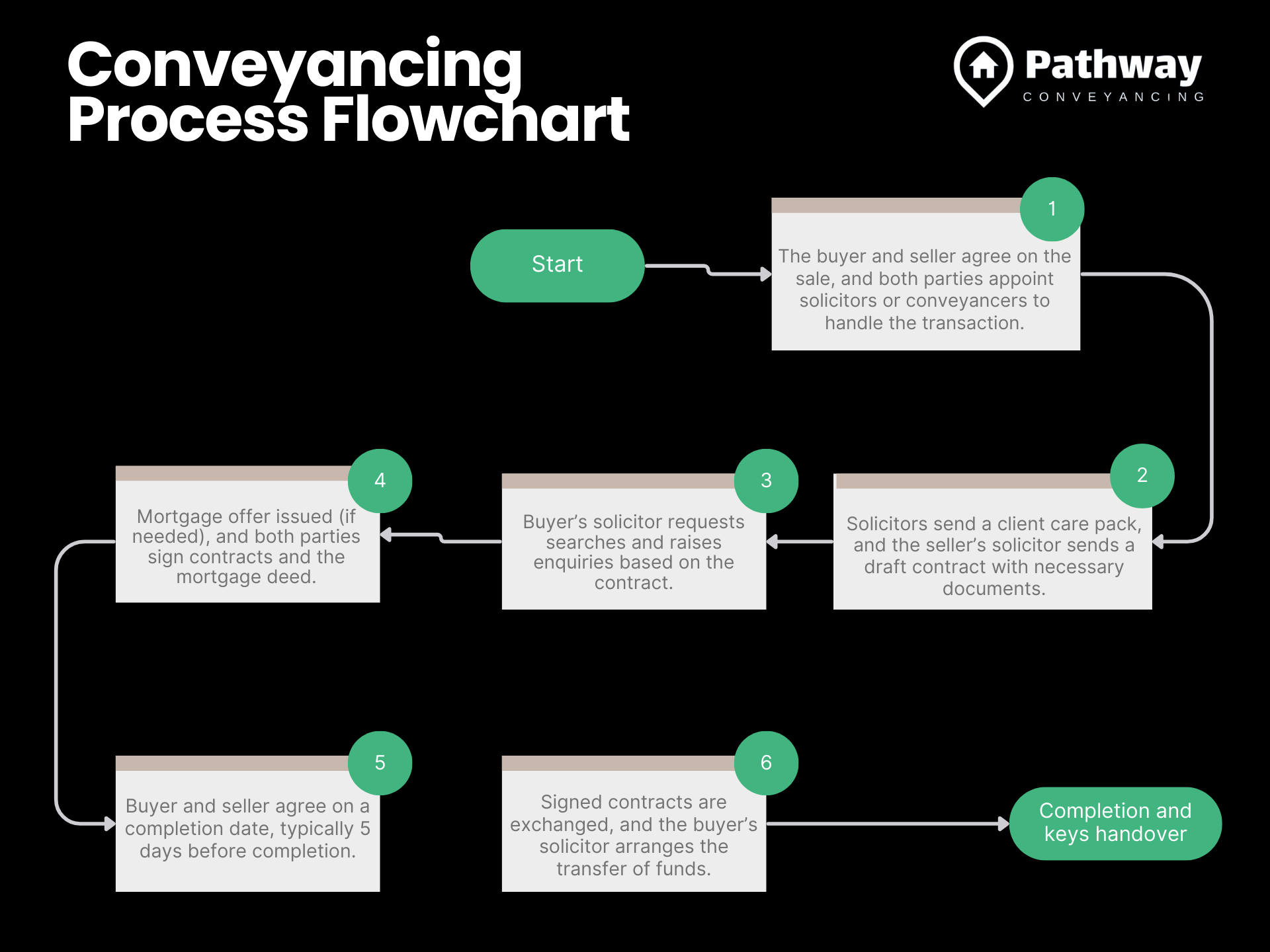

Conveyancing Process Flowchart UK

Conveyancing is the legal process of transferring property ownership from the seller to the buyer. For most people, buying or selling a property is one of the largest transactions they will ever make, so understanding the conveyancing process can make a significant difference.

In this blog, we’ll break down the key steps involved in the process, giving you a clear picture of what to expect.

1. Offer Accepted & Solicitors Appointed

Once an offer on a property has been accepted, the next step is to appoint a solicitor or licensed conveyancer. Both the buyer and the seller must have legal representation to handle the paperwork and ensure the transaction complies with the law.

Your solicitor will guide you through the legalities, ensuring that all necessary documents are completed and that any issues are identified early on. Choosing an experienced conveyancer is crucial, as they’ll be your primary contact throughout the transaction and will keep you informed of progress.

2. Client Care Pack & Draft Contract Pack

Once the solicitors are appointed, they will begin their respective tasks.

For the buyer, the solicitor will send out a client care pack, which includes important forms such as proof of identity and other required details that need to be completed and returned. It’s important to send these documents back promptly to avoid delays.

The seller’s solicitor, on the other hand, will start preparing a draft contract pack. This includes the title deeds, property plans, any protocol forms, and relevant leasehold information (if applicable). The draft contract outlines the terms of the sale, which is then sent to the buyer’s solicitor for review.

This stage is often where the groundwork for the transaction is laid. The documents sent out in this phase ensure that all the legal and factual details about the property are clearly defined.

3. Searches & Enquiries

After the buyer’s solicitor receives the draft contract, they will begin conducting various searches. These searches are designed to uncover any potential issues with the property that could affect its value or desirability.

Common property searches include:

- Local Authority Searches: Checking for planning permissions, restrictions, or potential developments in the area.

- Environmental Searches: Ensuring the land the property is built on is not contaminated.

- Water and Drainage Searches: Verifying water supply and drainage services.

- Chancel Repair Liability: Checking whether the property is liable for contributing to church repairs, which is rare but still possible.

During this time, the buyer’s solicitor will also raise enquiries based on the information provided in the draft contract and the results of the searches. These questions can cover any aspect of the property or sale, such as whether there are ongoing disputes or any unclear title issues.

The seller’s solicitor is responsible for responding to these enquiries, and this can be a time-consuming stage depending on the complexity of the sale.

4. Mortgage Offer & Signing of Contracts

If the buyer is using a mortgage to finance the purchase, the lender will issue a formal mortgage offer at this stage. The offer is typically sent to the buyer, their solicitor, and the financial advisor, detailing the terms and conditions of the loan.

The buyer will need to review and sign the mortgage deed, which is a legal document outlining the buyer’s commitment to repay the loan. Once the mortgage offer is in place, both the buyer and seller are ready to sign the contracts.

The solicitor will send the contracts to the buyer and seller for signing. It’s important for both parties to carefully read and understand the terms before signing, as these contracts will soon become legally binding.

5. Completion Date Set

Before the contracts are exchanged, the buyer and seller must agree on a completion date. This is the day when the sale is finalised, and the buyer takes ownership of the property.

Typically, there is a gap of at least five working days between the exchange of contracts and the completion date. This allows time for the solicitors to complete all remaining formalities and for the buyer’s solicitor to arrange the transfer of funds from the lender.

The completion date is usually flexible and agreed upon by both parties based on their respective schedules. However, the process can move more quickly in straightforward cases where no mortgage is involved.

6. Exchange of Contracts

Once the contracts are signed and the completion date is set, the solicitors will exchange contracts. At this point, the transaction becomes legally binding, and both parties are committed to completing the sale.

If either party backs out after this stage, they could face significant penalties. For example, if the buyer pulls out, they will typically lose their deposit, which is often 5-10% of the purchase price.

During the exchange, the buyer’s solicitor will also send a completion statement outlining all the costs, including legal fees, stamp duty, and the remaining balance of the purchase price. The buyer’s solicitor will arrange for the mortgage lender to transfer the required funds to complete the sale.

7. Completion & Handover of Keys

The final step is completion, which typically occurs on the agreed completion date. On this day, the buyer’s solicitor will transfer the purchase funds to the seller’s solicitor. Once the funds have been received, the seller’s solicitor confirms that the sale is complete.

At this point, the buyer takes legal ownership of the property, and the keys can be released. The buyer will usually collect the keys from the estate agent, although in some cases, they might be handed over directly by the seller or their solicitor.

After completion, the buyer’s solicitor will register the buyer as the new owner of the property with HM Land Registry, and the process is officially complete.

Related:

What is Commercial Conveyancing?

What is Residential Conveyancing?

What is the difference between Leasehold vs Freehold?

Can a property buyer and seller use the same solicitor?

How can I transfer personal property to a business?

Post-Completion: What Happens Next?

After the sale is completed and the keys are handed over, there are still a few important steps that need to be taken to ensure everything is in order. These steps are managed by the buyer’s solicitor and involve finalising the legal details of the transaction.

Once the funds have been transferred and the sale is completed, the buyer’s solicitor will register the buyer as the new owner of the property with HM Land Registry. This ensures that the legal title of the property is updated to reflect the new ownership. The Land Registry will issue an updated title deed, confirming the buyer's legal ownership. This process usually takes a few weeks, but it is an essential step to make the ownership official and ensure the buyer's rights are protected.

If applicable, the buyer’s solicitor will also handle the payment of Stamp Duty Land Tax (SDLT). SDLT is a government tax that must be paid on property purchases above a certain threshold. The amount of SDLT payable depends on the purchase price of the property, and there are different rates for first-time buyers, buy-to-let properties, and second homes.

The solicitor will ensure that the correct amount of tax is calculated and submitted to HMRC within 14 days of completion. Failure to pay SDLT on time can result in penalties, so it’s important that this is handled promptly.

After the property is registered with HM Land Registry and SDLT is paid, the buyer will receive the title deeds from their solicitor. These documents are proof of ownership and will include any details about the property, such as easements, covenants, or restrictions on the land. While many title deeds are now held digitally by the Land Registry, it’s important to keep any physical copies or relevant documents in a safe place for future reference.

Potential Delays in the Conveyancing Process

Although the conveyancing process can be straightforward in many cases, there are potential delays that can slow down the transaction. Understanding these delays and how to mitigate them can help buyers and sellers avoid unnecessary stress.

Common causes of delays include issues with searches, where a local authority is slow in responding to search requests, or if an environmental issue is uncovered, which can delay the transaction. Mortgage delays can occur if the buyer’s lender takes longer than expected to process the mortgage offer.

Legal issues with the property, such as unclear ownership or disputes over boundaries, will need to be resolved before the sale can proceed. Additionally, if the property is part of a chain, any delays with other transactions in the chain can stall the entire process.

To minimise delays, it’s important for both buyers and sellers to respond promptly to their solicitors, return required documents as soon as possible, and stay in close communication with their estate agents and solicitors to address any potential issues early on. Organising finances in advance, particularly for buyers who are taking out a mortgage, can also help avoid delays.

Conveyancing for Leasehold Properties

The process of buying or selling a leasehold property is generally more complex than freehold transactions, due to the involvement of the freeholder and the need to review additional legal documents.

The buyer’s solicitor will need to carefully review the lease, checking for important details such as the remaining term of the lease, ground rent, service charges, and any restrictions or obligations imposed on the leaseholder.

The seller’s solicitor will request a management pack from the freeholder or managing agent, which contains information about the property’s service charges, planned maintenance, and any disputes involving other leaseholders. Obtaining this management pack can be a common cause of delays in leasehold transactions.

The buyer’s solicitor will also need to serve a Notice of Transfer to the freeholder, notifying them of the change in ownership. In some cases, a Notice of Charge is also required if the buyer is using a mortgage to purchase the property. These notices often come with additional fees, which should be factored into the overall costs of buying a leasehold property.

The Role of the Buyer and Seller in the Conveyancing Process

While much of the conveyancing process is handled by solicitors, both the buyer and seller play important roles in ensuring the transaction runs smoothly. Buyers are responsible for providing information to their solicitor, such as proof of identity and financial details, and returning signed documents like the contract and mortgage deed in a timely manner.

Buyers also need to ensure that they have arranged their mortgage and have the funds in place to cover the deposit, legal fees, and other costs like Stamp Duty Land Tax. Additionally, buyers should arrange buildings insurance from the moment contracts are exchanged, as they become responsible for the property from that point onwards.

Sellers, on the other hand, must provide accurate information about the property, including details of any disputes, alterations, or issues that could affect the sale. The seller’s solicitor will prepare the draft contract and respond to any enquiries raised by the buyer’s solicitor. On the day of completion, the seller is responsible for ensuring the property is vacated and all keys are handed over, either to the estate agent or directly to the buyer.

Ensuring that everything is in order on completion day helps to avoid any last-minute complications.

Want a free, no obligation legal consultation?

We want to know your needs exactly so that we can provide the perfect solution. Get a free, no-obligation consultation today.