Wills vs. Trusts: Which is Right for You?

Estate planning is a crucial step in ensuring that your assets are distributed according to your wishes after you pass away. Two key tools commonly used in estate planning are wills and trusts. While both serve the same fundamental purpose of helping you manage and distribute your assets, they operate in different ways and offer distinct advantages. Understanding these differences is essential for choosing the right approach for your specific circumstances.

In this comprehensive guide, we’ll explore what wills and trusts are, how they work, and which one might be right for you based on your estate planning needs. We’ll also delve into the types of trusts available, the tax implications, and scenarios where one may be preferable over the other.

What is a Will?

A will is a legally binding document that sets out how your estate—your money, property, and personal possessions—will be distributed after your death. It’s the most straightforward way to ensure that your assets go to the people or causes you care about, rather than being distributed according to the UK’s intestacy rules (which apply if you die without a will).

Key Features of a Will:

- Designates beneficiaries: You can specify who should inherit your assets.

- Appoints executors: A will names the individuals who will be responsible for carrying out your wishes (known as executors).

- Names guardians for minors: If you have young children, your will can appoint legal guardians to care for them.

- Funeral wishes: You can include your preferences for funeral arrangements.

Types of Wills

There are several types of wills, including:

- Single Will: A standard will for one individual.

- Mirror Wills: Common for couples, where the wills reflect each other’s wishes.

- Living Will: Also known as an Advance Decision, this outlines your wishes regarding medical treatment if you cannot communicate them.

A will is a simple, effective way to ensure that your loved ones are taken care of after your death. However, it only comes into effect once you have passed away, meaning it has no impact on how your assets are managed during your lifetime.

What is a Trust?

A trust is a legal arrangement that allows a third party, known as the trustee, to hold and manage assets on behalf of the beneficiaries. Trusts are flexible and can be set up to manage assets during your lifetime (a living trust) or after your death (a testamentary trust).

Unlike a will, which only becomes effective after your death, trusts can come into effect as soon as they are created. This makes them a useful tool not only for passing on assets but also for managing them during your lifetime, particularly if you become incapacitated or want to avoid probate.

Key Features of a Trust:

- Flexibility: Trusts allow you to manage your assets both during your life and after death.

- Control: You can set specific conditions on how and when beneficiaries will receive assets.

- Avoids probate: Trusts can help your estate avoid the probate process, making the transfer of assets quicker and more private.

- Tax advantages: Certain types of trusts can reduce inheritance tax liabilities.

Types of Trusts

Trusts come in many forms, each serving different purposes. Common types of trusts include:

- Bare Trust: Beneficiaries have an immediate right to the assets, which are held by the trustees until the beneficiary reaches a certain age.

- Discretionary Trust: The trustees have full discretion over how the assets are distributed among the beneficiaries.

- Life Interest Trust: One beneficiary receives income from the assets for life, while the capital passes to another beneficiary after the first beneficiary’s death.

- Charitable Trust: Assets are held for charitable purposes and can offer significant tax benefits.

Trusts are especially useful in complex family situations or where you want to ensure a greater level of control over how and when your assets are passed on to beneficiaries.

When Should You Use a Will?

A will is essential for most people, especially if your estate is straightforward, and you simply want to ensure your assets are distributed according to your wishes. Here are the main situations where a will is the best option:

1. Straightforward Estates

If you have a relatively simple estate—such as a home, savings, and a few possessions—a will is usually sufficient. You can clearly outline who should inherit your assets, and the process of executing your will is relatively straightforward.

2. Appointing Guardians for Children

If you have minor children, it is crucial to have a will. A will is the only way to legally appoint guardians who will care for your children in the event of your death.

3. Low-Cost Solution

Wills are generally more affordable to create than trusts. For individuals or families with basic estate planning needs, a will provides the necessary legal protection without the higher costs associated with establishing a trust.

4. Funeral Instructions

Wills allow you to include your funeral and burial preferences, giving your loved ones clear guidance on how you want to be laid to rest.

5. Intestacy Rules

Without a will, your estate will be distributed according to intestacy rules, which may not align with your wishes. A will ensures that your loved ones are provided for in the way you intend.

When Should You Use a Trust?

While a will is essential, trusts offer additional benefits that may make them a better option in certain situations. Here are scenarios where a trust might be the best choice:

1. Complex Family Situations

If you have a blended family or dependents with different needs, a trust can provide flexibility in distributing assets. For example, a discretionary trust allows you to give trustees the power to decide which beneficiaries receive funds and when, based on their needs at the time.

2. Asset Protection

Trusts are ideal if you want to protect assets from creditors, divorce, or bankruptcy. By placing assets in a trust, they are no longer considered part of the beneficiary’s personal estate, offering a layer of protection against financial difficulties.

3. Managing Assets During Your Lifetime

Unlike wills, trusts can take effect while you are still alive. This allows you to manage your assets and ensure that they are used according to your wishes, even if you become incapacitated. For example, a living trust can appoint someone to manage your assets if you are no longer able to do so.

4. Avoiding Probate

One of the key benefits of trusts is that they allow your estate to bypass probate, which is the legal process of administering your will. Avoiding probate can save time and money, and it keeps your estate matters private.

5. Minimising Inheritance Tax

Certain types of trusts can help reduce your inheritance tax liability. For example, by placing assets in a discretionary trust, you may remove them from your estate, lowering the overall value of your estate for tax purposes.

Tax Considerations for Wills and Trusts

One of the major reasons individuals choose trusts over wills is the tax benefits they can provide. While both wills and trusts are subject to inheritance tax, trusts often allow for more flexibility in reducing your tax liabilities.

1. Inheritance Tax (IHT) on Wills

When you pass away, your estate may be subject to inheritance tax at 40% on the value of your estate over the nil rate band (currently £325,000). However, there are some exemptions and reliefs that can reduce this tax burden, including:

- Spouse Exemption: Transfers to your spouse or civil partner are usually exempt from inheritance tax.

- Charitable Donations: Leaving at least 10% of your estate to charity can reduce the IHT rate to 36%.

- Residence Nil Rate Band (RNRB): An additional allowance if you leave your home to your children or grandchildren.

2. Inheritance Tax on Trusts

Trusts offer more nuanced tax advantages, but they are also subject to various tax rules. For example:

- Bare Trusts: Assets are treated as belonging to the beneficiary, meaning there’s no additional tax when assets are distributed.

- Discretionary Trusts: These can be subject to a 10-yearly charge and an exit charge when assets leave the trust, but they can also help remove assets from your estate for IHT purposes.

- Life Interest Trusts: These may not reduce your IHT liability during your lifetime, but they can be useful for providing income to a beneficiary while preserving the capital for future generations.

It’s essential to consult with a solicitor or tax advisor to understand the tax implications of your estate planning choices.

Combining Wills and Trusts

In many cases, it’s not a matter of choosing between a will and a trust—you can use both to create a comprehensive estate plan. For example, you can use a will to specify your funeral arrangements and appoint guardians for your children, while using a trust to manage complex assets, protect your estate from creditors, and minimise taxes.

How to Use Both in Your Estate Plan:

- Will: Use a will to cover straightforward distributions of assets, such as personal possessions, and to appoint guardians for minor children.

- Trust: Use a trust to manage more complex assets, provide for beneficiaries over time, and reduce inheritance tax liabilities.

By combining the two, you can benefit from the simplicity and cost-effectiveness of a will while also taking advantage of the flexibility and tax benefits of trusts.

Conclusion: Wills, Trusts, or Both?

Both wills and trusts are powerful tools in estate planning, but they serve different purposes. A will is essential for ensuring that your assets are distributed according to your wishes and that your loved ones are cared for. Trusts, on the other hand, offer greater control over how your assets are managed and can help minimise taxes and protect your estate from legal challenges.

For most people, a combination of both wills and trusts will provide the best protection for their estate. By working with an experienced estate planning solicitor, you can create a strategy that fits your specific needs, ensures your wishes are respected, and provides for your family in the most efficient way possible.

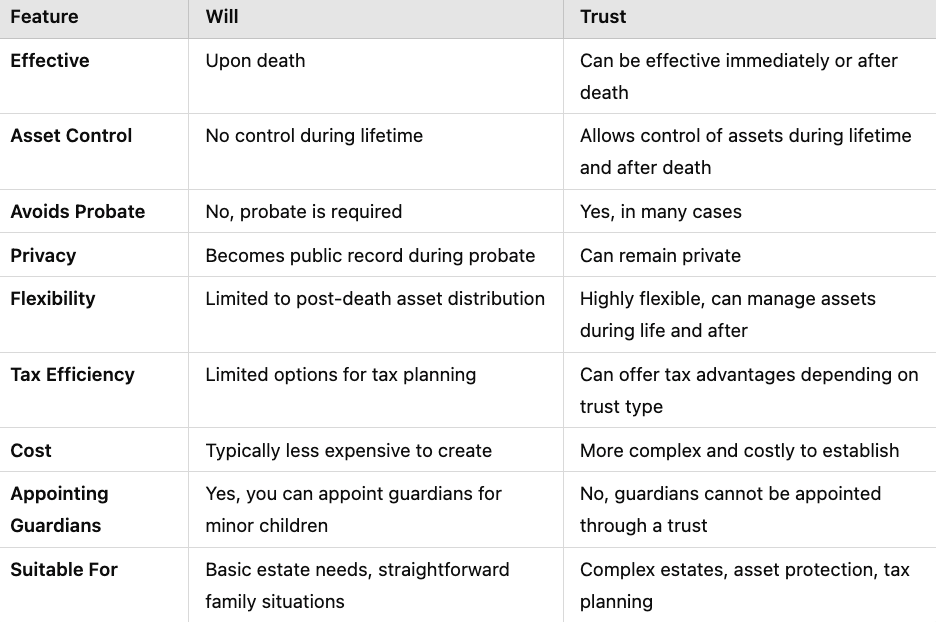

Wills vs. Trusts: Key Differences

While both wills and trusts are used to manage and distribute assets, they differ in several key ways. Understanding these differences will help you decide which option is right for you.

Want a free, no obligation legal consultation?

We want to know your needs exactly so that we can provide the perfect solution. Get a free, no-obligation consultation today.